A negative variance means that you spent more than budgeted, which is unfavorable. Fixed manufacturing overhead costs remain the same in total even though the production volume increased by a modest amount. For example, the property tax on a large manufacturing facility might be $50,000 per year and it arrives as one tax bill in December. The amount of the property tax bill did not depend on the number of units produced or the number of machine hours that the plant operated.

In the following month, the company receives a large order whereby it must produce 20,000 toys. At $1.50 per unit, the total variable overhead costs increased to $30,000 for the month. Typically fixed overhead costs are stable and should not change from the budgeted amounts allocated for those costs. However, if sales increase well beyond what a company budgeted for, fixed overhead costs could increase as employees are added, and new managers and administrative staff are hired.

- These costs remain constant regardless of production and business profit, like administrative costs, insurance costs, or rent.

- He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

- Consequently a further favourable variance of $1,200 is recorded for efficiency reasons (the company was efficient because it produced 6,000 standard hours worth of product in 5,400 hours).

- The percentage of your costs that are taken by overhead will be different for each business.

- If you are a corporate accountant, you probably have to deal with variance analysis and reporting on a regular basis.

This can be expenses like rent and utilities, indirect materials like office cleaning supplies, and indirect labor costs like accounting and advertising. Examples of fixed overhead costs that are specific to a production area (and which are usually allocated to manufactured goods) are factory rent, utilities, production supervisory salaries, and normal scrap. While administrative staff salaries are a fixed cost since they must be paid regardless of output, some types of labor costs can be classified as variable.

Causes of Overhead Variance

Indirect labor are costs for employees who aren’t directly related to production. An overhead cost, contrary to a direct cost, cannot be traced to a specific piece of a company’s revenue model, i.e. these costs support operations, as opposed to directly creating more revenue. Suppose a manufacturing company is trying to determine its overhead rate for the past month. Companies with fewer overhead costs are more likely to be more profitable – all else being equal.

- To find your average monthly overhead, add all overhead costs for the year and divide that number by 12.

- The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

- Fixed overhead costs can change if the activity level varies substantially outside of its normal range.

- Fixed manufacturing overhead costs remain the same in total even though the production volume increased by a modest amount.

- The direct material cost is one of the primary components of the product cost.

Because of its fixed component, manufacturing overhead tends to be over applied when actual production is greater than standard production. Once you’ve categorized the expenses, add all the overhead expenses for the accounting period to get the total overhead cost. Connie’s Candy used fewer direct labor hours and less variable overhead to produce 1,000 candy boxes (units). Suppose Connie’s Candy budgets capacity of production at 100% and determines expected overhead at this capacity. Connie’s Candy also wants to understand what overhead cost outcomes will be at 90% capacity and 110% capacity. The following information is the flexible budget Connie’s Candy prepared to show expected overhead at each capacity level.

Formulas to Calculate Overhead Variances

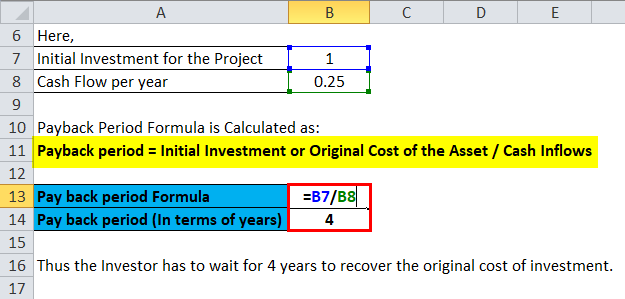

The equation for the overhead rate is overhead (or indirect) costs divided by direct costs or whatever you’re measuring. Direct costs typically are direct labor, direct machine costs, or direct material costs—all expressed in dollar best free small business accounting software amounts. Each one of these is also known as an “activity driver” or “allocation measure.” The overhead rate is a cost added on to the direct costs of production in order to more accurately assess the profitability of each product.

Improve Your Business With Overhead Cost Data

In spite of not being attributable to a specific revenue-generating component of a company’s business model, overhead costs are still necessary to support core operations. Conversely, companies with more variable costs than fixed might have an easier time reducing costs during a recession since the variable costs would decline with any decline in production due to lower demand. For simplicity assume that there was no fixed overhead expenditure variance, that is that actual overhead expenditure was as budgeted.

Basic accounting concepts — AccountingToolsBasic accounting concepts — AccountingTools

However, the actual cost of fixed overhead that incurs in the month of August is $17,500. In practice other measures of activity, in particular direct labour hours (DLHs), are used as an absorption base. Graph 3 shows a situation where actual activity is greater than budgeted activity and actual overhead expenditure is as budgeted.

If the extra inventory is stockpiled, the company will not profit from the reduction of overhead costs per unit. Fixed manufacturing costs, which make up the overhead, also include the cost of leases, the interest element of loans and the payment of utility bills, such as water and electricity. This is because variable costing will only include the extra costs of producing the next incremental unit of a product. Try to be sure to include all fixed, variable, and semi-variable overhead costs. By their nature, variable costs may go down as business activity declines, but that’s not a desired outcome.

This metric helps you separate direct material cost from your total product cost. In order to cover the cost of overhead in the price you charge for your product — assuming you sell at least 250 units — you would have to charge $58 for each unit. While this is a necessity for larger manufacturing businesses, even small businesses can benefit from calculating their overhead rate. Overhead Costs represent the ongoing, indirect expenses incurred by a business as part of its day-to-day operations. Graph 4 shows a situation where both actual activity and actual overhead expenditure differ from budget. Kenneth W. Boyd has 30 years of experience in accounting and financial services.

Overhead Rate Formula and Calculation

Answer 2 was the most popular of the wrong answers, which suggests that candidates understood that situation (1) leads to over absorption and that it was situation (2) that caused the problem. If actual hours worked are below budget then by applying the predetermined absorption rate (which is based on budgeted hours) to this lower number of actual hours will lead to under absorption. In this case actual activity is greater than budgeted, leading to over absorption. At the same time actual overhead is lower than budgeted, also leading to over absorption. In some industries, companies might want to calculate the overhead cost per employee, perhaps to make staffing decisions, analyze team profitability, set prices, or make budgeting decisions.