It represents the rate of return at which the project breaks even, helping to gauge its potential profitability. NPV measures the difference between the present value of cash inflows and the present value of cash outflows over a project’s lifetime. The discounted payback period of 7.27 years is longer than the 5 years as calculated by the regular payback period because the time value of money is factored in. To calculate payback period with irregular cash flows, you will need to calculate the present value of each cash flow.

Discounted Payback Period: Definition, Formula & Calculation

- The shortest payback period is generally considered to be the most acceptable.

- This investment decision involves evaluating contribution limits, tax advantages, and investment options within the account.

- That’s why business owners and managers need to use capital budgeting techniques to determine which projects will deliver the best returns, and yield the most profitable outcome.

- Investments with higher cash flows toward the end of their lives will have greater discounting.

Considering Tesla’s warranty is only limited to 10 years, the payback period higher than 10 years is not idea. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

Leverage and Capital Structure

Thus, you should compare your year-end cash flow after making an investment. Once you have this information, you can use the following formula to calculate discounted payback period. The payback period for this project is 3.375 years which is longer than the maximum desired payback period of the management (3 years).

Example 3: Bond Investment

Often an investment that requires a large amount of capital upfront generates steady or increasing returns over time, although there is also some risk that the returns won’t turn out as hoped or predicted. With positive future cash flows, you can increase your cash outflow substantially over a period of time. Depending on the time period passed, your initial expenditure can affect your cash revenue. The payback period value is a popular metric because it’s easy to calculate and understand. However, it doesn’t take into account money’s time value, which is the idea that a dollar today is worth more than a dollar in the future.

A large purchase like a machine would be a capital expense, the cost of which is allocated for in a company’s accounting over many years. No such adjustment for this is made in the payback period calculation, instead it assumes this is a one-time cost. A payback period refers to the time it takes to earn back the cost of an investment.

According to payback method, machine Y is more desirable than machine X because it has a shorter payback period than machine X. According to payback period analysis, the purchase of machine X is desirable because its payback period is 2.5 years which is shorter than the maximum payback period of the company. The equation doesn’t factor in what’s happening in the rest of the company. Let’s say the new machine, by itself, is working wonderfully and operating at peak capacity. But perhaps it’s a huge draw on the plant’s power, and its affecting other systems. Perhaps other machines need to be shut down for extended periods in order to allow this new machine to produce.

It is a measure of how long it takes for a company to recover its initial investment in a project. It is one of the simplest capital budgeting techniques and, for this reason, is commonly used to evaluate and compare capital projects. As the equation above shows, the payback period calculation is a simple one.

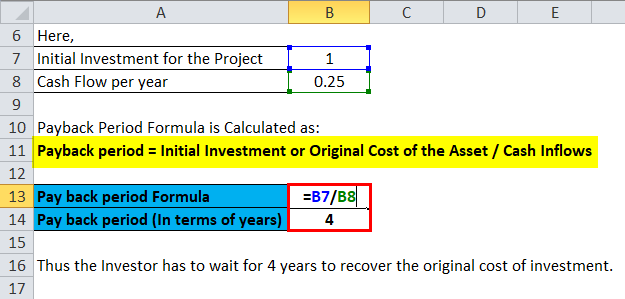

For more detailed cash flow analysis, WACC is usually used in place of discount rate because it is a more accurate measurement of the financial opportunity cost of investments. WACC can be used in place of discount rate for either of the calculations. The payback period is a simple measure of how long it takes for a company to recover its initial investment in a project itemized tax deduction calculator from the project’s expected future cash inflows. It measures the liquidity of a project rather than its profitability. As such, it should not be used alone as an investment appraisal technique – other methods should be used such as ROI, NPV or IRR. In its simplest form, the payback period is calculated by dividing the initial investment by the annual cash inflow.