The concept of marketing has evolved from production to creating value for the customers. Today the customers don’t buy the product simply because they are available, but if they add value to the customer. Here, you will find top 70 Marketing MCQs with answers and explanations. These Marketing multiple-choice questions are helpful for the students and professionals who are studying in MBA, MMS, BBA, BCom, MCom, and others marketing management related courses.

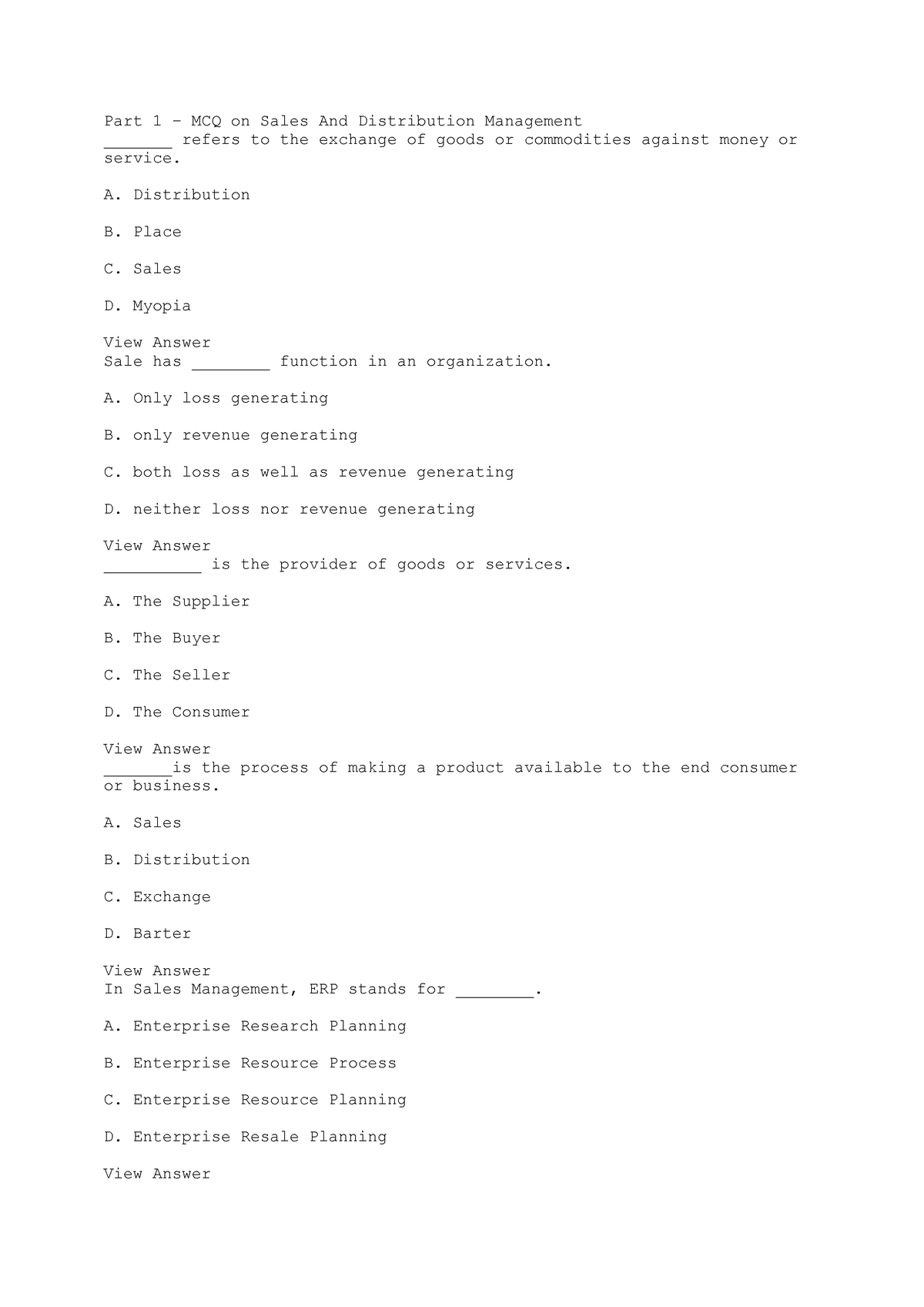

Latest Sales Management MCQ Objective Questions

At the Introduction stage the marketer should not focus on profits or sales. The main objective at this stage should be to make customers aware of the product and willing to try it. Writing the mission statement is essential to create a successful marketing plan. A well-written mission statement gives a clear direction and the marketing plan can be developed to achieve the goals.

Top Sales MCQ Objective Questions

Analyzing sales data, tracking performance metrics, and continuously improving sales processes are essential for long-term success. Demographic segmentation identifies a market segment based on the physical and social traits of target customers such as age, gender, income, etc. While every other company was focusing on new features and technological advancements, Apple focused on creating great value for the customer through innovation in its products.

Sales Management MCQ Quiz – Objective Question with Answer for Sales Management – Download Free PDF

- Sales knowledge also involves familiarity with sales tools and technologies, such as CRM software, sales analytics, and marketing automation platforms.

- Therefore, the correct statements when an organization uses intensive distribution of its products are B.

- It is a fundamental aspect of business that directly impacts revenue generation and business growth.

- Diversification is a concept where a company not only focuses on new products but also explores new markets.

- When the marketing goals are achieved through successful utilization of strategies and plans it is said to be well implemented.

In a Price skimming strategy a company sets high prices for its products eventually reducing the price to meet the market average. Logistics management focuses majorly on Supply chain management. WWhen a product is offering some unique benefits to the customers it must be superior to its counterparts. If the solutions offered are not superior to its competitors, customers may not show interest in switching to that product. These mediums are primarily used to spread awareness among consumers and promote the products and services among the target consumers. In the Product Concept the marketers believed that if a product is readily available at a lower price, the customers will prefer to buy it over a product that is difficult to find and expensive.

It becomes a Want when the customer decides that the need can be fulfilled by a specific product. New Entrants are competitors which bring new dimensions to the market competitors. The producers, online invoicing portal wholesalers, and retailers work in a straight chain and fulfill the task to make the products available to the end user. Marketing, according to Philip Kotler, is neither a science nor an art.

In Direct Channel the company does not depend on intermediaries like distributors, wholesalers, or retailers to make the products available to the customers. Diversification is a concept where a company not only focuses on new products but also explores new markets. The companies focused on producing new products and a demand was created automatically. Monitoring the competitor’s activities helps the company to modify its plans and activities to remain profitable and sustained in the market. Important PointsTwo-way conversation -The ideal instrument for selling to individuals is this. Personal selling is an Oral communication & Conversation with customers.

They also share their opinions about the products among their social circles. In product line pricing the company adds features to the base product and charges more for the features, as compared to the base product. Thus, Personal selling includes Oral communication, Face to face interaction & Conversation with customers. Key Points The Advertising Standards Council of India (ASCI) was formed in 1985. It was established by professionals from the advertising and media industry to keep Indian ads decent, fair, and honest.

When the marketing goals are achieved through successful utilization of strategies and plans it is said to be well implemented. There is always an imbalance between the customer’s actual and desired state. A marketer’s key role is to recognize this gap and recognize a feasible solution. In today’s time a marketer has to be both a creative and critical thinker. With these two capabilities, the marketer can better understand the consumers and come up with solutions that add value. The early adopters are willing to take the risk and try new things.

The most widely recognized form of PPC advertising is through search engines like Google, where advertisers use Google Ads to bid on keywords and create ads. The ads are displayed prominently when someone searches for the specified keywords, and advertisers are charged only when someone clicks on their ad, hence the term “pay-per-click.” The concept of supermarkets developed with the idea of Self-service. Where a customer picks and buys a product without any sales assistance. At the introduction stage many companies keep their prices low as a part of the strategy to penetrate the market. When a customer does not evaluate a product or service based on the merits and price he is displaying emotional buying behavior.

However, during personal selling, when the salesperson is in close to the customers, he or she learns more about their preferences and tastes. The companies focused on social and ethical concerns in their marketing activities during this period. In the current times, the focus has shifted to adding value to the customers. Therefore, the correct statements when an organization uses intensive distribution of its products are B. If the product is not selling despite all the marketing activities, either the marketing plan or the product is at fault.

In Viral Marketing a company uses social media platforms to bring awareness and create a brand image among the masses on a large scale. At the Growth stage the product gains market share and the sales go high. However, a lot of efforts and expenses are occurred to achieve this growth. A company does competitor analysis and makes changes to its budget and plans to stay competitive in the market by adjusting to the practices of the competitor.