With dedicated barcode scanning features, you can also ensure accurate, real-time inventory and order tracking, timely inventory rotation, and fewer human errors with decreased time-consuming manual tasks. Whether you’re using FIFO, LIFO, accurate cost, or some other inventory management method, Extensiv can help you streamline and optimize inventory management, warehousing, and shipping processes. For FIFO success, you need effective collaboration and communication strategies–not just with your employees, but also with suppliers across your supply chain. This can help ensure timely inventory delivery and accurate product documentation. You should also create clear communication channels with your suppliers about FIFO requirements and expectations.

FIFO Fundamentals Critical for Inventory Management & Business Success

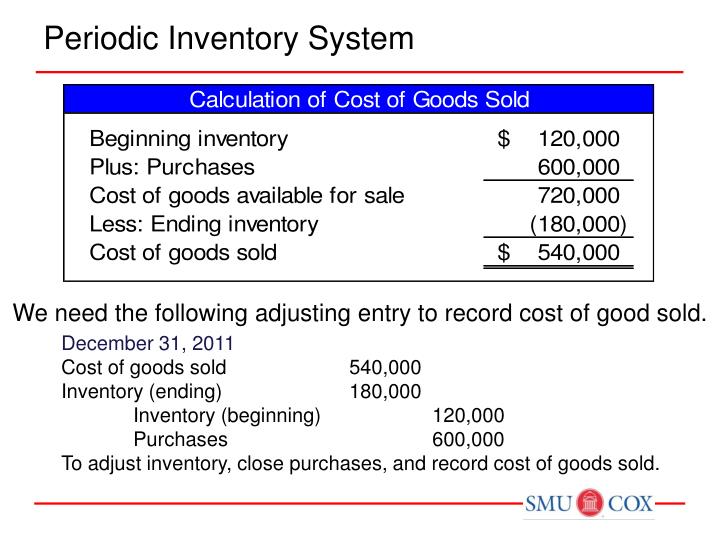

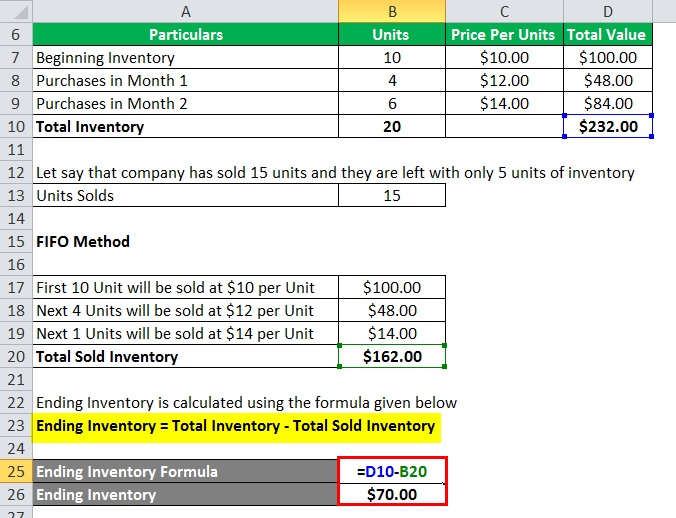

The FIFO method is the first in, first out way of dealing with and assigning value to inventory. It is simple—the products or assets that were produced or acquired first are sold or used first. With FIFO, it is assumed that the cost of inventory that was purchased first will be recognized first. FIFO helps businesses to ensure accurate inventory records and the correct attribution of value for the cost of goods sold (COGS) in order to accurately pay their fair share of income taxes.

Is FIFO applicable to all businesses?

Her areas of expertise include accounting system and enterprise resource planning implementations, as well as accounting business process improvement and workflow design. Jami has collaborated with clients large and small in the technology, financial, and post-secondary fields. Sal’s Sunglasses is a sunglass retailer preparing to calculate the cost of goods sold for the previous year. Average cost inventory is another method that assigns the same cost to each item and results in net income and ending inventory balances between FIFO and LIFO.

Step 2: Calculate the Ending Inventory Cost by Summing the Costs of the Most Recently Purchased Goods

It’s also highly intuitive—companies generally want to move old inventory first, so FIFO ensures that inventory valuation reflects the real flow of inventory. First in, first out (FIFO) is an inventory method that assumes the first goods purchased are the first goods sold. This means that older inventory will get shipped out before newer inventory and the prices or values of each piece of inventory represents the most accurate estimation. FIFO serves as both an accurate and easy way of calculating ending inventory value as well as a proper way to manage your inventory to save money and benefit your customers. It’s also the most accurate method of aligning the expected cost flow with the actual flow of goods.

How Is the FIFO Method Calculated?

No, because there are other inventory cost flow assumptions that might be a better fit for some businesses. For instance, those selling commodities with fluctuating prices may benefit from the average cost method rather than FIFO. First-in, first-out, also known as the FIFO inventory method, is one of four different ways to assign costs to ending inventory. Companies must make an assumption about their flow of inventory goods to assign a cost to the inventory remaining at the end of the year. FIFO is a straightforward valuation method that’s easy for businesses and investors to understand.

What Is FIFO Method: Definition and Guide

For example, using its inventory management tool, you can view which orders are committed/allocated against a particular SKU and/or warehouse. Implementing FIFO can also be complex, requiring meticulous inventory tracking and management procedures that can be resource-intensive. Warehouse managers must ensure accurate inventory labeling and tracking, whats the difference between a plan a budget and a forecast implement effective inventory storage solutions, and ensure staff rotates inventory based on receiving dates. As the size of your operations and inventory management increases, implementing FIFO gets harder. FIFO is popular among companies because it simplifies tracking the flow of costs—the goods purchased first are the ones sold first.

- It’ll do all of the tedious calculations for you in the background automatically in real time.

- Rohit Rajpal is an accomplished writer with a deep understanding of technology, digital marketing, and customer service.

- As the price of labor and raw materials changes, the production costs for a product can fluctuate.

- To determine if FIFO is the right choice for you, assess your inventory characteristics, understand customer demands and industry standards, and review your operational requirements and goals.

- First in, first out (FIFO) is an inventory method that assumes the first goods purchased are the first goods sold.

And, in some cases, FIFO could actually decrease profit margins, especially during inflation or when inventory costs increase. This method ensures that the first products you purchase or create are the first to go out when customers place orders. By using older stock first, FIFO reduces the likelihood of inventory stagnation and minimizes holding costs. Accounting standards are only concerned with cost flow assumptions as they affect inventory valuation in the financial statements. The biggest disadvantage to using FIFO is that you’ll likely pay more in taxes than through other methods.

The FIFO method of inventory management aligns new orders with oldest inventory to ship first to decrease distribution of outdated or expired goods. Under the FIFO, the goods that were purchased most recently should be part of ending inventory. We’ll explore how the FIFO method works, as well as the advantages and disadvantages of using FIFO calculations for accounting. We’ll also compare the FIFO and LIFO methods to help you choose the right fit for your small business. Warehouse management refers to handling inventory and similar tasks within a warehouse environment.

The actual inventory valuation method used doesn’t have to follow the actual flow of inventory through a company but it must be able to support why it selected the inventory valuation method. Theoretically, the cost of inventory sold could be determined in two ways. One is the standard way in which purchases during the period are adjusted for movements in inventory. The second way could be to adjust purchases and sales of inventory in the inventory ledger itself. The problem with this method is the need to measure value of sales every time a sale takes place (e.g. using FIFO, LIFO or AVCO methods).

At the end of the year 2016, the company makes a physical measure of material and finds that 1,700 units of material is on hand. Learn more about what LIFO is and its impact on net income to decide if LIFO valuation is right for you. In the chemicals industry, FIFO is essential for managing chemicals and raw materials that have a limited shelf life or require specific storage conditions. This is important, since materials may include structural steel, cement, lumber, prefabricated windows, and more. Calculating the cost of goods sold (COGS) with FIFO is a straightforward process.

FIFO, or First In, Fast Out, is a common inventory valuation method that assumes the products purchased first are the first ones sold. This calculation method typically results in a higher net income being recorded for the business. In contrast to the FIFO inventory valuation method where the oldest products are moved first, LIFO, or Last In, First Out, assumes that the most recently purchased products are sold first.