Creating an AML compliance program procedure is essential, but it doesn’t have to be difficult. Jumio’s AML solutions can quickly help you construct an effective risk what is aml risk assessment methodology that is cost-efficient and easy to implement. A risk assessment helps keep you safe from money-laundering schemes run by financial criminals.

Any single indicator does not necessarily determine the existence of lower or higher risk. Update your policies and procedures as needed and ensure that the appointed compliance officer reviews them to keep them aligned with regulatory changes. This, along with a strong culture of compliance, can minimize the risk that your organization will be involved with money laundering. Inherent risk refers to those factors that affect your organization when you have not taken any steps to mitigate them. Think about it this way – the inherent risks are present just because your organization exists and conducts a certain type of business.

How We Help Your AML Compliance?

This is where further checks that are specific to the individual arise, such as customer due diligence – and, in the case of the more high-risk customers – enhanced due diligence. The risk assessor must determine how the organization carries out its business operations and what AML precautions are in place to avoid the sale of products/services that can be exploited by money launderers. If you work with many cash-intensive businesses, you are more prone to compliance issues because of their compromised behavior. You must assume that at least some of these organizations are engaged in illegal activity. New companies and new products can also more easily hide suspicious activity, making them higher risk because regulators have no information on either.

To assure that BSA/AML compliance programs are reasonably designed to meet BSA regulatory requirements, banks structure their compliance programs to be risk-based. While not a specific legal requirement, a well-developed BSA/AML risk assessment assists the bank in identifying ML/TF and other illicit financial activity risks and in developing appropriate internal controls (i.e., policies, procedures, and processes). Understanding its risk profile enables the bank to better apply appropriate risk management processes to the BSA/AML compliance program to mitigate and manage risk and comply with BSA regulatory requirements. The BSA/AML risk assessment process also enables the bank to better identify and mitigate any gaps in controls.

The Ultimate Fraud Risk Assessment Checklist in 2023

As shown above, when a user enters a prospective customer’s email address, SEON’s software is able to determine whether that account is connected to a lack of social and digital footprints. Let’s have a closer look at the necessary actions to achieve the process, and at all stages, the assessor must always remember to document their methodology and the experience throughout the process. Often, excessive dealings with foreign entities are a red flag, especially if they are countries with lax financial laws. Laundering money through off-shore accounts is one historically successful way to avoid AML enforcement.

The BSA/AML risk assessment should provide a comprehensive analysis of the bank’s ML/TF and other illicit financial activity risks. Documenting the BSA/AML risk assessment in writing is a sound practice to effectively communicate ML/TF and other illicit financial activity risks to appropriate bank personnel. The BSA/AML risk assessment should be provided to all business lines across the bank, the board of directors, management, and appropriate staff.

Steps for Completing an AML Risk Assessment

You’re able to decide on the most cost-effective way to control the risks of money laundering when you follow the steps involved in the risk-based approach. How to use a risk-based approach to carry out compulsory risk assessments of your business. Willie Maddox, CPA, CAMS, CRCM, is executive vice president and chief risk officer at Atlantic Community Bankers Bank.

- The enhanced focus on using risk assessments to increase AML program effectiveness is consistent with federal and state regulatory priorities.

- This is where further checks that are specific to the individual arise, such as customer due diligence – and, in the case of the more high-risk customers – enhanced due diligence.

- AML risk assessment is a thorough, systematic process designed to detect, evaluate, and mitigate the risks of money laundering and terrorist financing linked to a business relationship.

- Financial institutions should not only ensure their risk assessment processes are fit for purpose, but also evaluate the governance regarding risk awareness and acceptance.

- When the risk environment changes, risk assessments should be updated to reflect the new circumstances.

- Effective AML risk assessments are an important factor in a financial institution’s ability to meet its regulatory obligations.

In response to FATF Recommendation 20, most of the world’s jurisdictions, including all of the major banking nations, have adopted rigorous suspicious activity reporting regimes. Regulatory oversight across various jurisdictions includes examinations to assure compliance with the laws and regulations governing suspicious activity reporting. The AML risk assessment process does not stop after the steps we just described – it is a continuous process.

Train Staff to Identify Risky Customers and Geographies

It achieves this by monitoring and assessing known vulnerabilities, also commonly referred to as Key Risk Indicators (KRIs). AML360 software manages the measurement and reporting of money laundering and terrorism financing risks. The AML/CFT risk report provides separate divisions of (a) nature, size and complexity of business, (b) products, services and transactions, (c) customers (B2B and B2C), (d) method of delivery and (e) geographies. The use of technology in building risk assessment methodologies and processes assists financial institutions in complying with the latest AML/CFT regulations.

‘You Could Save a Life’: AML Survivor Reflects on Stem Cell … – Curetoday.com

‘You Could Save a Life’: AML Survivor Reflects on Stem Cell ….

Posted: Mon, 02 Oct 2023 22:08:19 GMT [source]

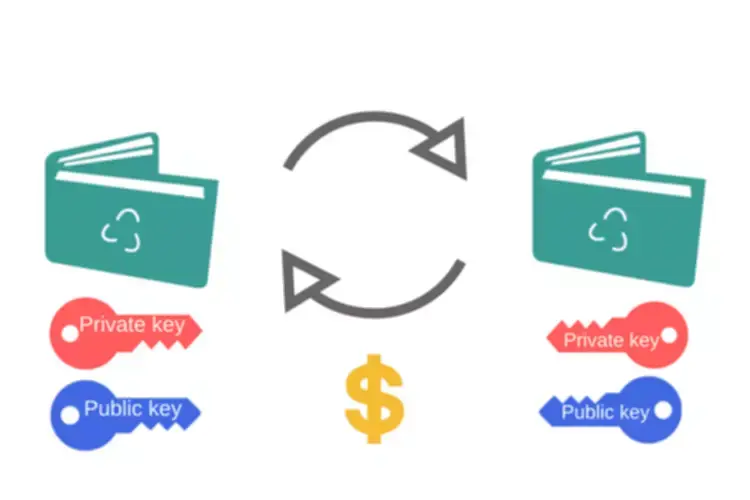

Your AML process should evaluate these factors over time to see if the risks are increasing, decreasing, or stable. Money laundering occurs when criminals try to make illicit funds appear to come from a legitimate source. Technology has made it easier for perpetrators to engage in money laundering, so it is more important now than ever that businesses implement a system to detect and prevent it.

The Solution for Meeting Today’s Regulatory Challenges

Each of these KRIs includes several risk drivers that influence how relevant they are to your organization. As such, the AML assessment will need to include a risk range so that you can take appropriate action. The frequency that an SRA needs to be completed and its level of comprehensiveness depends on the risk profile of the institution, and how that risk profile is changing overtime, as well as considering internal resource availability. Identifies risk across your organization’s products, high-risk customer types, and geographies. In addition to the above, businesses ought to be cautious when dealing with customers that perform actions that are at odds with their profile.