Trust accounting is the bookkeeping of clients’ income and expenses that are held in trust. This type of accounting for law firms may include assets from settlements or retainers fees. These funds held in a trust are not the law firm’s property but are individuals or institutions known as trustees.

Safeguarding Financial Health

At least once a month, review your receivables and follow up on outstanding client invoices to keep your cash flow strong. Accounts receivables, also known as A/R, are amounts owed to you by clients. Staying on top of receivables is essential to the financial health of your business. Grow Law Firm is a top law firm SEO agency with the sole mission of helping law firms take their operations to the next level. Call us today for a free consultation and learn what Grow Law Firm can do for you. Book your demo today to see how Clio Accounting can manage your bookkeeping and accounting from the same place you manage everything else for your firm.

Stay On Top of Your Taxes

General ledger accounting is a fundamental pillar for the financial success of any law firm. Proper general ledger accounting safeguards the firm’s financial health and builds trust with clients and regulators. Avoiding common mistakes, such as misclassifying transactions or failing to maintain separate trust accounts, can prevent costly errors and ensure the smooth operation of the firm. Implementing robust internal controls, automation tools, and regular training further enhances the accuracy and reliability of financial management. Ultimately, mastering general ledger accounting gives law firms the tools to thrive in a competitive landscape, ensuring long-term stability and success. By carefully comparing these three sets of data, law firms can maintain stricter control over their financial transactions and ensure compliance with regulatory requirements.

The Benefits of Mastering Your Law Firm’s Bookkeeping

- This is essential, especially in paying workers’ compensation insurance and mandatory disability.

- Partnering with a knowledgeable CPA can provide the expertise and support required for success in this complex area of law firm accounting.

- Regardless of which state you’re in, you cannot under any circumstances use an IOLTA account as a savings account or an operating account, even if the money you withdraw from the IOLTA has already been earned.

- Ethical violations can lead to serious consequences, such as disbarment, penalties, or fines.

- Think of it as a systematic roadmap that categorizes and organizes all financial transactions within your firm.

Cash basis accounting does not include revenues earned if the client hasn’t paid, and it doesn’t include expenses that haven’t been paid or reimbursed. The use of such software is crucial for managing escrow or trust accounts, case cost https://www.a1levelrepair.com/DesignProject/ allocation, and 1099 reconciliations to ensure compliance and efficient bookkeeping. Legal accounting specialists must meticulously maintain precise accounting records for transparent financial oversight of law firm operations.

The legal accounting specialist plays a crucial role in the smooth operation of a law firm, ensuring that financial matters are handled efficiently and accurately. By selecting the right accounting software and integrating it with the firm’s existing technology infrastructure, law firms can simplify their accounting processes and better manage their financial operations. One of our major advantages is that we commit to delivering jargon-free financials in real time, ensuring that your business can https://www.otrezal.ru/73/nastoyashhem.html understand and act upon its financial data with ease. By automatically recording all transactions from bank accounts and credit/debit cards, We take the hassle out of data entry, allowing retailers and wholesalers to focus on their core operations. Accurate financial records provide law firms with the necessary data to make informed, strategic decisions. From resource allocation to fee structures, every choice is enhanced when backed by a thorough understanding of the firm’s financial landscape.

Flexible Payment Options

The same person dealing with the big-picture financial strategy is knee-deep in day-to-day transaction tracking. Moreover, Clio allows users to ensure compliance with different state rules and regulations when using Interest on Lawyers’ Trust Accounts (IOLTA), thereby simplifying complex legal accounting processes. Law firms can run into unnecessary expenditures if they have poor bookkeeping and accounting practices. Missing out on opportunities for growth and revenue can lead to extra costs that could have been avoided. To identify growth opportunities, law firms can utilize financial reports and statements. By analyzing these reports, firms can pinpoint areas for reducing overhead costs, improving efficiency, and achieving financial growth.

- For instance, technology like Clio Manage offers resources for legal billing and trust accounting management, enabling law firms to make informed decisions based on their financial data.

- This focus on detail requires excellent organizational and time management skills to ensure efficiency and accuracy, especially during the verification successful waiting process.

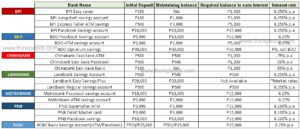

- Once you’ve chosen a bank to work with, you’ll want to open a business checking account, a savings account, and an IOLTA (Interest on Lawyers Trust Account).

- You will also want to inquire about their relevant education and training in bookkeeping and financial account management.

What software solutions are recommended for managing a law firm’s accounting needs?

Law firms must maintain a clear separation between operating and client funds, which further complicates the bookkeeping process. Cash basis accounting records financial transactions when cash is received or paid, while accrual basis accounting records transactions when they are earned or incurred, regardless of cash flow. In the context of a law firm, cash basis accounting may be simpler and easier to manage, as it requires tracking only actual cash transactions.

Differentiating Between Accounting and Bookkeeping for Law Firms

- Providing several flexible payment options can help your team get paid faster and improve payment collection.

- Outlining your firm’s expenses and then setting realistic goals for business financial management will keep you on track and help you better manage financial obligations.

- Bookkeeping provides a clear cash flow picture, allowing your firm to make informed decisions about resource allocation, investment opportunities, and operational strategies.

- This process involves choosing a name, selecting a business structure, and filing paperwork required by your local jurisdiction.

Because of poor training, lack of accounting help, or differing IOLTA rules across state lines, many attorneys are unfamiliar with what they are and aren’t allowed to put into an IOLTA account. Once you’ve chosen a bank to work with, you’ll want to open https://onlystyle.com.ua/ru/otdyh/ekspert-ispolzovanie-onlajn-instrumentov-daet-agentstvam-preimushhestva-v-pogone-za-klientami.html a business checking account, a savings account, and an IOLTA (Interest on Lawyers Trust Account). Every business is different, and the “right bank” for you will depend on the nature of your practice and the way you prefer to get your banking done.

Billing errors or mismanagement of client funds can violate ethical standards and lead to serious legal consequences. Firms should ensure their billing practices comply with legal ethics rules to prevent this. Additionally, double-checking expense tracking related to client matters is essential for maintaining professional standards. Legal accounting tools facilitate accuracy and enhance efficiency through automated calculations and in-depth financial reporting. Moreover, effective communication skills in legal accounting are key to establishing trust and understanding with clients, which is crucial for their retention and the law firm’s reputation. Forecasting, on the other hand, involves predicting future financial outcomes based on historical performance and current trends.