The absorption cost per unit is the variable cost (\(\$22\)) plus the per-unit cost of \(\$7\) (\(\$49,000/7,000\) units) for the fixed overhead, for a total of \(\$29\). Variable costing is quite commonly used by management to assist with a variety of decisions. For example, one might conduct a breakeven analysis to determine the sales level at which a business earns a zero profit.

Absorption Costing Explained

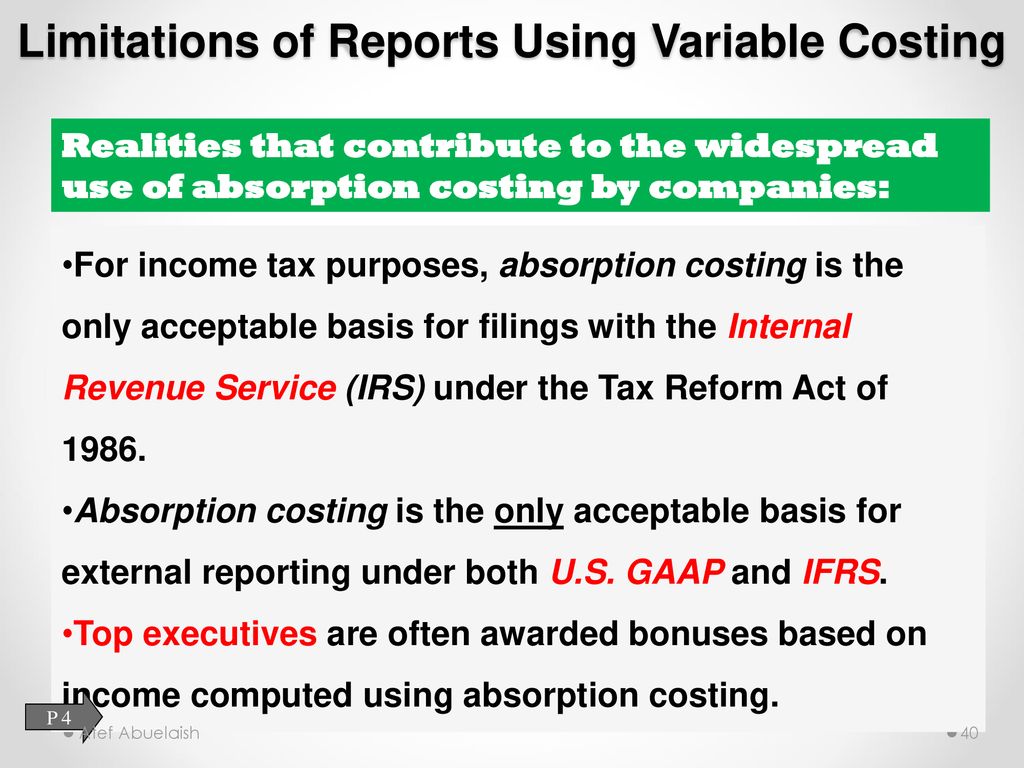

Absorption costing “absorbs” all of the costs used in manufacturing and includes fixed manufacturing overhead as product costs. Absorption costing is in accordance with GAAP, because the product cost includes fixed overhead. Variable costing considers the variable overhead costs and does not consider fixed overhead as part of a product’s cost. It is not in accordance with GAAP, because fixed overhead is treated as a period cost and is not included in the cost of the product.

Analysis of the Impact of Costing Methods on Financial Performance

Under variable costing, fixed factory overhead costs are expensed in the period in which they are incurred, regardless of whether the product is sold yet. Under absorption costing, fixed factory overhead costs are expensed only when the product is sold. Using the absorption costing method on the semimonthly definition and meaning income statement does not easily provide data for cost-volume-profit (CVP) computations. In the previous example, the fixed overhead cost per unit is $1.20 based on an activity of 10,000 units. If the company estimated 12,000 units, the fixed overhead cost per unit would decrease to $1 per unit.

What are the five major GAAP principles?

For instance, it impacts pricing strategies, budgeting, and financial planning. Additionally, different costing methods provide varied insights into operational efficiency and cost control, helping managers make informed decisions to enhance profitability and competitiveness. Therefore, understanding and selecting the appropriate costing method is essential for accurate financial reporting and effective management.

Key Differences

A company may also be required to use the absorption costing method for reporting purposes if it prefers the variable costing method for management decision-making purposes. Using the absorption costing method will increase COGS and thus decrease gross profit per unit produced so companies will have a higher breakeven price on production per unit. Customers will pay a slightly higher retail price.

Cost Accounting for Ethical Business Managers

It may be beneficial to use the variable costing method depending on a company’s business model and reporting requirements or at least calculate it in dashboard reporting. Managers should be aware that both absorption costing and variable costing are options when reviewing their company’s COGS cost accounting process. Direct materials, direct labor, and both variable and fixed overhead costs.

- To allow for deficiencies in absorption costing data, strategic finance professionals will often generate supplemental data based on variable costing techniques.

- Securities and Exchange Commission from 2010 to 2012 to come up with an official plan for convergence.

- Using variable costing would have kept the costs separate and led to different decisions.

- Second, if a company offers special deals on a selective basis, regular customers may become alienated or hold out for lower prices.

- Both Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) require that an entity report its actual costs incurred when reporting expenses.

Though this does mean that the reported gross margin is higher, it does not mean that net profits are higher – the overhead is charged to expense lower in the income statement instead. However, this is only the case when the level of production matches sales. The reverse situation occurs when sales exceed production.

The total of direct material, direct labor, and variable overhead is \(\$5\) per unit with an additional \(\$1\) in variable sales cost paid when the units are sold. Additionally, fixed overhead is \(\$15,000\) per year, and fixed sales and administrative expenses are \($21,000\) per year. The purpose of this article is to provide a comprehensive understanding of the different costing methods under GAAP. It aims to clarify the principles, advantages, and disadvantages of each method, helping businesses and accounting professionals make informed decisions. Variable costing is a methodology that only assigns variable costs to inventory. This approach means that all overhead costs are charged to expense in the period incurred, while direct materials and variable overhead costs are assigned to inventory.

If the units are not sold, the costs will continue to be included in the costs of producing the units until they are sold. This treatment is based on the expense recognition principle, which is one of the cornerstones of accrual accounting and is why the absorption method follows GAAP. The principle states that expenses should be recognized in the period in which revenues are incurred. Including fixed overhead as a cost of the product ensures the fixed overhead is expensed (as part of cost of goods sold) when the sale is reported.

Accountants in particular should be familiar with the ten key principles. Although exact GAAP requirements may vary depending on the industry, it is necessary to adhere to the principles at all times. Accountants must, to the best of their abilities, fully and clearly disclose all the available financial data of the company. They are obligated to acquire this information from the business, which is why an accounting team’s requests may seem intensely thorough when requesting financial information. Outside the U.S., the most commonly used accounting regulations are known as the International Financial Reporting Standards (IFRS). The IFRS is used in over 100 countries, including countries in the European Union, Japan, Australia and Canada.